A trading journal is a trading book you write about your own journey, system, risk management and lessons learned. It helps you clearly see your past mistakes so you don’t repeat them in the future. Your edge as a trader is the advantage you have over other traders with your system, psychology, risk management, or trade management that creates your profits from other’s losses.

Trading journal, trade management and performance tracking software. Forget your xls trading spreadsheet and get serious about your trading business. Stock, futures and options. Get free spreadsheet journal here. Cryptocurrency Trading Journal MyFxBook Journal. MyFxBook is an extremely well-known and popular website for tracking and verifying trading results. It is also excellent when being used as a trading journal. Learn what information should be recorded in a trading journal + get a free copy of my trading journal. This can be used as a Forex trading journal.

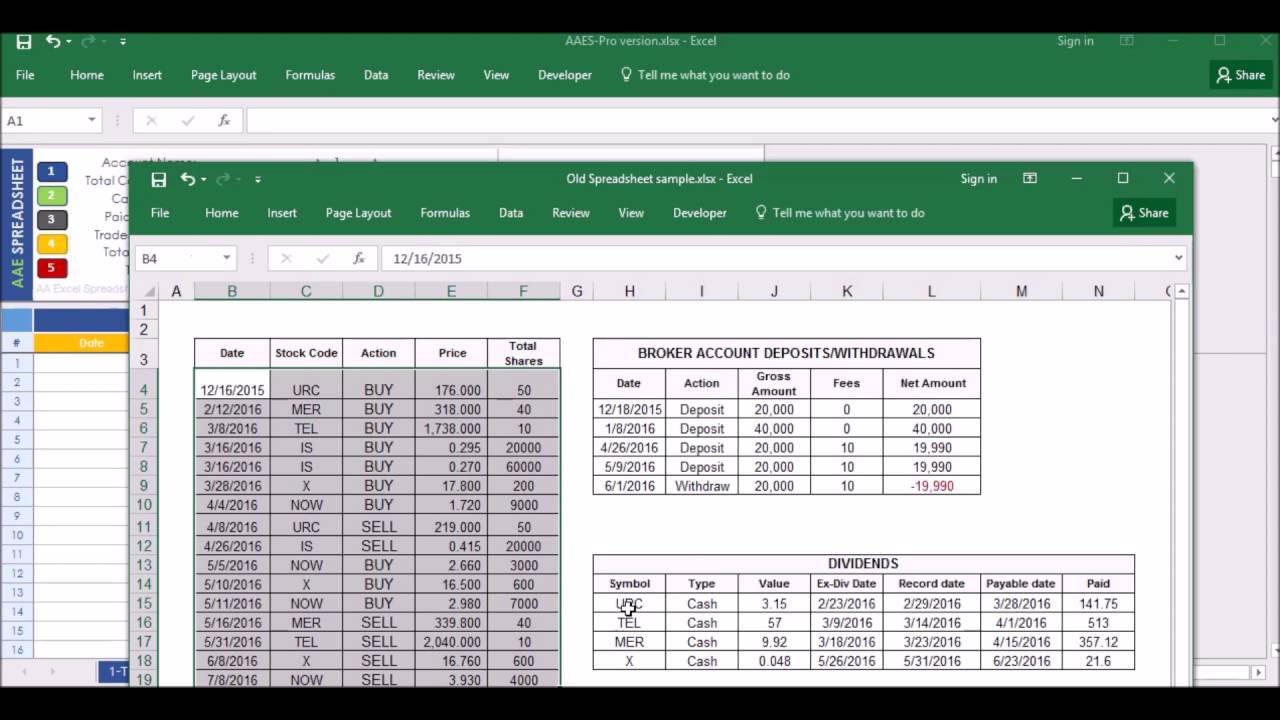

Looking for a Trading Journal Spreadsheet? Upgrade from the old way of journaling your trades on Excel, xlsx, spreadsheet or Google Sheet. TRY IT FREE FOR 7 DAYS. Free Trading Log Spreadsheet I think we all know that using a trading log for our trading activities is pretty vital to ensure we are moving forward in our trading profits. Sometimes we are so tuned into simply learning a system we forget that we have real money on the line.

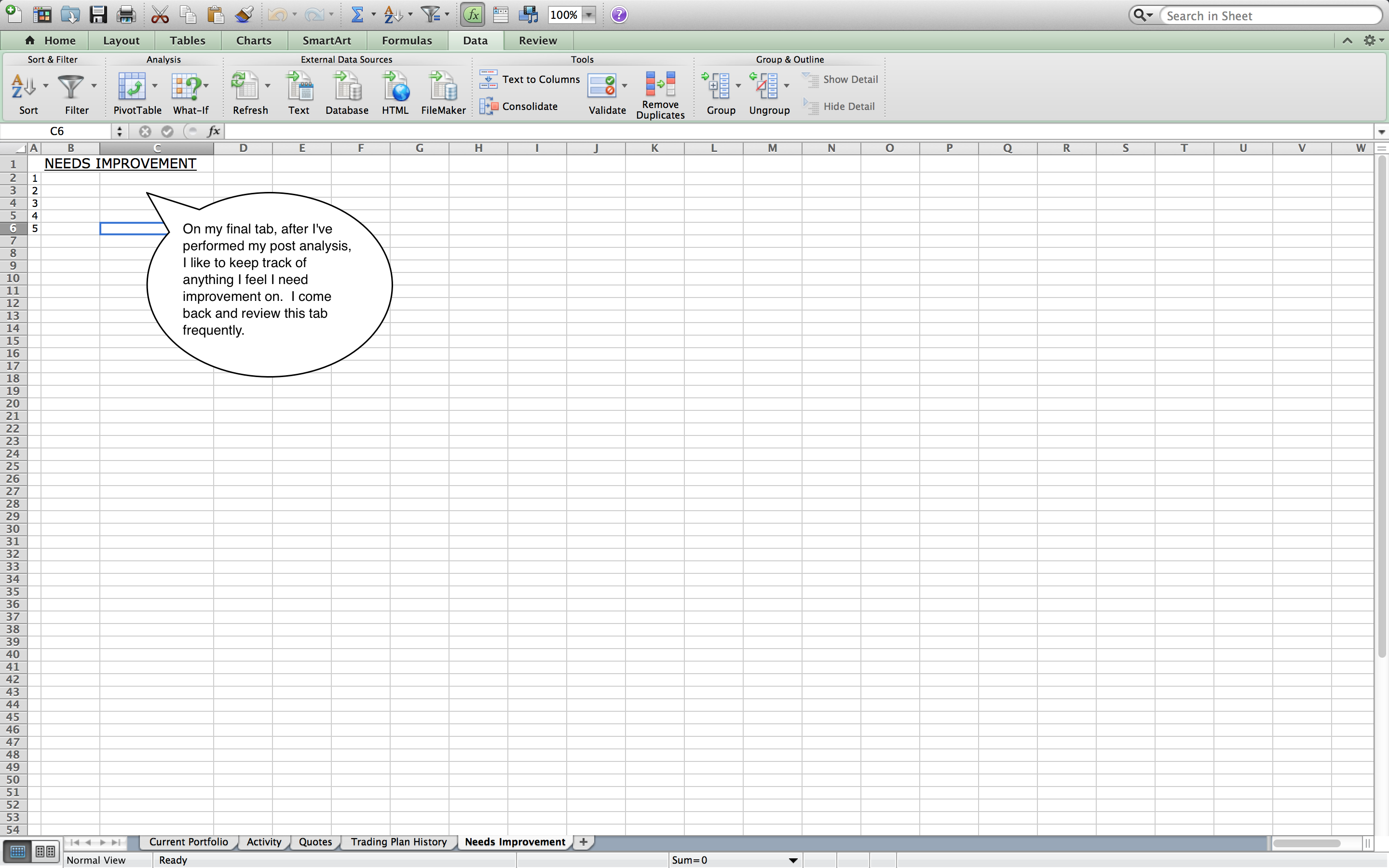

Keeping an up to date trading journal makes you put your feelings, thoughts, mistakes, risk management issues along with emotional and ego problems on paper. Writing helps clarify your thoughts, identify your errors, and become mindful of the emotions that lead to trading errors.

Forex Trading Journal Spreadsheet Free Download

Having a great trading plan and following that plan consistently are different things. The major causes of being and unprofitable trader are having no edge, mental mistakes, bad risk management or all of the above. A trading journal can document your mistakes and quantify where you are going wrong.

With the data and patterns you see from a detailed trading journal you can see both when you were disciplined and when you failed to follow your plan and why. The goal of good trading is not to make money every time but to follow your own trading systems, entries, exits, and position sizing with discipline every time. If you have a system with a edge and follow your process you will make money over time in the markets. You will lose money over the long term if you have no edge or if you have one but not the discipline to implement it.

How exactly you keep your trading journal is not as important as whether you do or not. A trading journal can be a notebook, on a spreadsheet, or using advanced software, however you like doing it.

Your trading journal should document the following things.

Before you start to trade:

- Your return expectations for your effort.

- Your risk tolerance for individual trading losses and total account drawdown limits.

- Quantify your statistical risk of ruin.

- What are the long term backtested results of the signals you will be using through multiple market environments?

- Your watchlist that meets your filter parameters.

- Are all the items on your watchlist liquid enough to trade with little slippage in the bid/ask spread?

- The quantified principles of your profitable trading system.

- The quantified entries and exit signals you will be following.

- Your position sizing parameters based on volatility.

- The rules for total risk exposure and correlation limits.

Here are ideas for what to document during each trade, take what is useful to you as you zero in on your own errors.

- Document your chart at entry.

- Your entries and why you chose to enter at that price.

- How do you feel on entry? What are your expectations?

- Your position sizing and why.

- Your initial stop loss plan if the trade moves too far against you.

- Your profit target expectation and why.

- How you plan to trail your stop loss.

- What is your risk/reward ratio based on your entry level versus your profit target.

- Document your chart after you exit.

- How did you feel on the exit?

- What errors of execution did you commit if any?

- What would you have done differently to minimize the size of a losing trade?

- What would you have done differently to maximize the size of a winning trade?

- Do you have any regrets?

- What were your thoughts during each stage of the trade?

- Did you have faith in yourself to follow your plan?

- Did you have faith in your signals to make money over the long term?

- Are you mentally comfortable trading this timeframe?

- Are you comfortable with your trading system?

- What was your stress level during each step of the trade?

- Does your trading system fit your own beliefs about the markets?

Tjs Trading Journal Spreadsheet Free Download

Here is an example of a free trading journal template in Microsoft Excel: Trade Journal.zipSource